How to make KYC compliance easier, faster and cheaper

Know Your Customer (KYC) compliance checks are critical in today’s globalised, digital world. With technology connecting more and more clients and businesses from all corners of the globe, it’s never been more important for companies to verify just who exactly they’re doing business with.

And that’s not all. National and intergovernmental efforts to curb criminal activities have led to increasingly tight regulations that your business must comply with, while your clients themselves are demanding robust anti-bribery and corruption (ABC) information. Verification and evaluation of any potential risk of illegal activity is, in turn, essential for your peace of mind and the reputation of your company.

With so many pros to conducting a thorough KYC check, why are KYC rules and regulations such a bitter pill to swallow for many organisations?

KYC checks are incredibly time-consuming

The biggest problem with traditional KYC screening is that the whole process can take an inordinate amount of time, which quickly becomes a significant bottleneck for business operations. This is true across the board—from trading firms and corporations to asset managers and hedge funds—with a complete KYC check with a new financial institution taking over six months to complete. This is not just a pain point for financial institutions, but for all professionals connected to the financial world, including lawyers, accountants and tax advisers. SMEs are perhaps hardest hit, where smaller workforces and tighter resources must go the same distance as larger corporations with deeper pockets.

« Manual KYC

checks are

estimated to cost

the average UK

bank 47 million

GBP a year. »

Inefficiencies drive up costs

The inefficiency of KYC checks drives up the costs of compliance considerably. According to a report from Consult Hyperion, manual KYC checks are estimated to cost the average UK bank 47 million GBP a year—a number that’s only expected to increase as AMLD5 is rolled out before the EU deadline of January 2020. When it can take over six months for a financial institution to complete due diligence checks and approve a new customer’s account, it’s only a matter of time before stakeholders become frustrated and lose interest in the business.

Manual searches lead to human errors

KYC processes involve searching through a huge number of different data sources, from government sanctions lists, watchlists and politically exposed person (PEP) lists to newspapers, blogs, and international court cases. With such a vast amount of information to sift through and an expansive range of tools to get to grips with, it’s no surprise that things may slip through the cracks. Getting the correct information is critical, as your company’s reputation and liability is on the line—and even minor human errors pose significant risks.

KYC compliance is quick and easy with Smart Oversight

One of the primary reasons KYC checks are so slow is that their methodology has failed to keep up with the political and technological developments of the wider environment. Thankfully, this doesn’t have to be the case any longer.

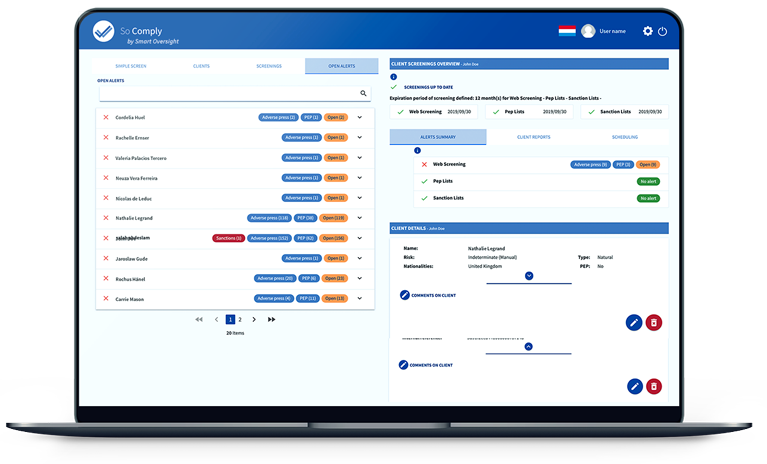

Smart Oversight is designed to help you save time on due diligence checks, while simultaneously ensuring a more accurate and comprehensive screening process. The tool eliminates practically all potential for human error while quickly identifying the problematic characteristics of a potential customer.

Our KYC & AML solutions reduce your compliance costs and workload to streamline compliance processes. The tool takes advantage of the latest tech to help small to large businesses overcome key KYC issues in several ways.

1. Everything you need in one online centralised tool

When using our compliance platform, you no longer need to sift through an excessive number of sources in the hopes of finding valuable information. This is because Smart Oversight curates everything you need into a single online tool, meaning you can access all the sanctions and PEP lists, as well as media information and other web screening, from a single dashboard. The tool can even aggregate your existing credentials to a private database, ensuring that your range of sources is as comprehensive as possible.

2. Improve identification with machine learning and NLP

Smart Oversight takes advantage of the latest in machine learning and Natural Language Processing (NLP) to improve the identification of PEP entourage—from family members to business associates. Not only does this make the search tool as thorough as possible, but meets your requirements for the FATF Recommendations and the AMLD4&5.

3. Spot negative media as soon as it’s published

Our NLP-based web screening tool is able to screen thousands of web pages in a minute. This permits you to spot negative media about an individual or a legal entity as they emerge—in more than 30 languages.

4. Keep on top of compliance with repeated monthly checks

Ongoing verification and screening is essential to ensure you’re prepared to resolve any issues as and when they arise. This is made simple, with the tool permitting you to automate periodic screenings and create customisable rules at a global or client level.

5. Export auditable reports in minutes

Once the tool has completed its comprehensive screening process, you will be able to generate a detailed report that you can export securely in PDF format. These reports are fully auditable, which will make it easier to fulfil AML compliance requirements.

6. Integration with existing processes

Thanks to our API, you can integrate Smart Oversight into your current workflow. This makes it even easier for your team to pick up the tool, as they can simply incorporate its functionality into their usual screening processes.

If you would like to learn more about how Smart Oversight can help you save time and reduce inefficiencies—while also protecting your company from regulatory, reputational and financial threats—start your free trial today. It only takes a few minutes to set up an account.