How to quickly meet your KYC compliance obligations

Increasingly tighter regulations around the world have meant that companies are facing ever greater demands when it comes to compliance. With the deadline for the transposition of the EU’s Fifth Anti-Money Laundering Directive fast approaching, it’s more important than ever that companies establish and maintain strong compliance processes.

While larger organisations and multinationals possess the resources and manpower to keep up with ‘know your customer’ (KYC) and anti-money laundering (AML) obligations, SMEs face even greater challenges when it comes to remaining compliant. What’s more, with companies under enormous pressure from clients to start work as soon as possible, some may add compliance checks to their to-do lists and take on a new client anyway – adding another risk factor to the mix.

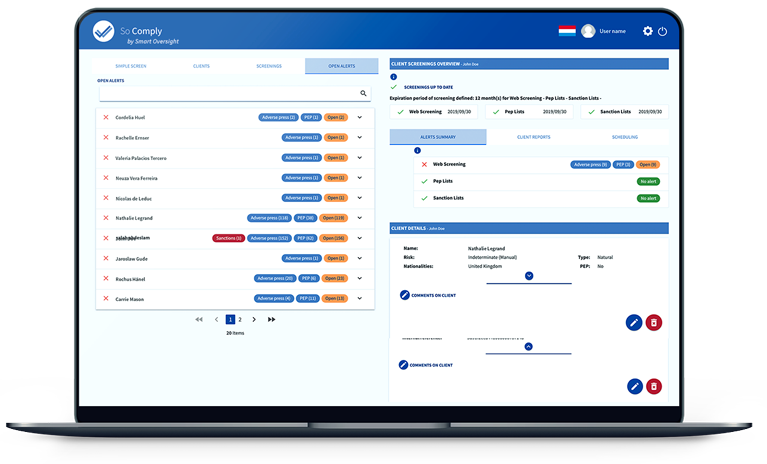

Yet bringing all your obligations up to date and maintaining your compliance processes doesn’t have to be so difficult. Smart Oversight was designed with SMEs in mind, and uses the latest NLP and automation mechanisms to make compliance with KYC obligations easier than ever.

First thing’s first: Screening

First of all, companies must meet the minimum requirements by checking if a client is on a sanction or politically exposed person (PEP) list. When dealing with a company, you must understand the corporate hierarchy and ultimate beneficial ownership, and screen this individual, too.

Heard something through the grapevine? Now more than ever, regulators want entities to curate and analyse press releases – something Smart Oversight is capable of. Ultimately, if the information is out there, regulators will expect you to know about it.

Assessing customer risk

If you’re dealing with a high-risk client, you’ll have to carry out enhanced due diligence (EDD). For KYC, this will involve exploring adverse media coverage. As for EDD for transactions, you must have a 360° understanding of a client’s transaction, and obtain the relevant supporting documents to confirm this.

Due diligence doesn’t stop there. Companies must remain vigilant – even when it comes to their regular clients. While organisations may perceive due diligence as a tick-box exercise, continuous monitoring and screening is vital. This doesn’t have to be a time-consuming process. The Smart Oversight tool allows you to automate periodic screenings and set customisable rules at a global or client level. While you get on with the work at hand, the tool handles the rest.

In addition, client monitoring must go hand in hand with transactional analysis on a granular level. You’ll need to ensure transactions are analysed in order to uncover any money-laundering red flags, and make sure this information is in line with your KYC and AML data.

Leaving a trail of compliance breadcrumbs

Last but not least, you need to ensure you have the correct documentation and audit trail to prove to regulators you are KYC- and AML-compliant. If a regulator begins an investigation, you’ll need to provide the appropriate documentation to prove your checks were comprehensive and compliant.

This is made simple with Smart Oversight, which generates a detailed report you can securely export in PDF format. These reports are fully auditable, which will make it even easier to fulfil AML compliance requirements.

Overcoming compliance challenges and meeting regulations are by no means impossible tasks. With Smart Oversight, you can reduce your workload and eliminate human oversight – all while keeping up with ever-evolving KYC and AML requirements.

Discover more about Smart Oversight and run your first background check in no time – simply book a demo today, and reap the rewards of our user-friendly and automated solution.